Intelligence that fuels

change and improves

financial resilience for all.

How We Help

Organizations Like Yours

As the leading independent authority on financial well-being in Canada, we empower purpose-driven organizations to profoundly understand, benchmark, and improve the financial health and resilience of their customers, employees, and communities. By partnering with us, these organizations accelerate innovation in their programs and services, leading to tangible improvements in customer loyalty, financial outcomes, and social outcomes.

Our Services

The Challenge

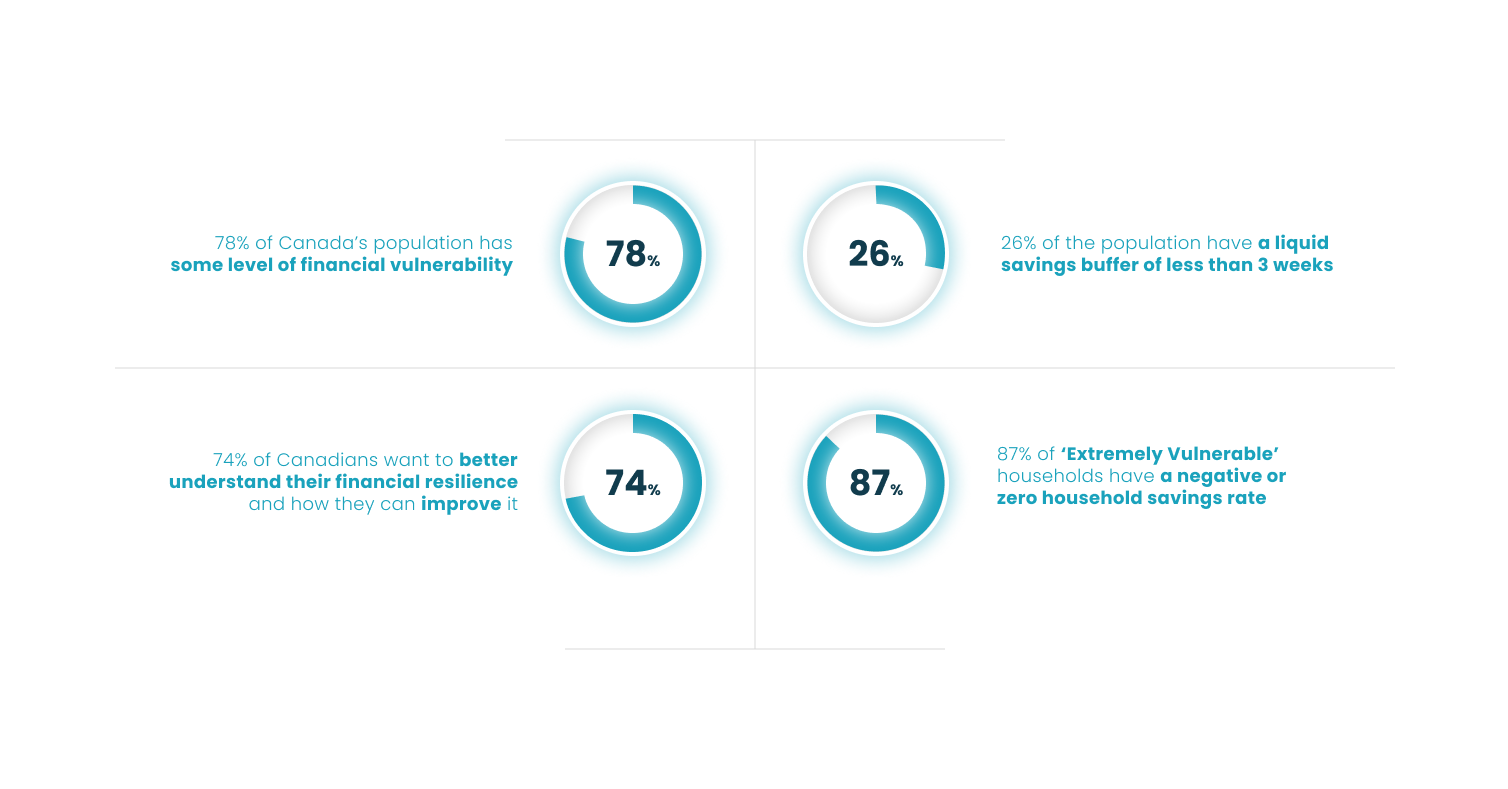

That Financial Vulnerability Brings

Financial vulnerability and financial stress are mainstream issues affecting Canadians of all income levels and in particular more vulnerable populations. Check out this video for more context around why we’re working to help improve financial resilience for all.

Are You

Looking To Have An Impact?

As of February 2024:

Join

Organizations Sharing Your Values

Recognize any of these brands.

All of them have worked with us, click on each logo to learn more.

Vancity is using the Index to measure and track the financial resilience and well-being of its members against long-term impact goals. The Institute has partnered with and advised the Credit Union on many projects from a financial health strategy and innovation perspective.

The Institute is partnering with Co-operators on a multi-phase enterprise-wide financial resilience project, to help the financial services organization to measurably improve the financial resilience and financial security of its clients and communities in line with its purpose. This work involved quantitative and qualitative research analytics, impact measurement, strategy and innovation, with our team working closely with Co-operators’ senior leaders, advisors, clients and an Advisory Group.

Data and research analytics is a team sport. Financial Resilience Institute (previously Seymour Consulting) and Statistics Canada have collaborated to publish a joint report on the financial resilience and financial well-being of Canadians during the COVID-19 pandemic, with the leading government statistical office having peer-reviewed the Seymour Financial Resilience Index TM.

Some People

Say The Nicest Things

Intelligence that fuels change and improves financial resilience for all.

How We Help

Organizations Like Yours

As the leading independent authority on financial well-being in Canada, we empower purpose-driven organizations to profoundly understand, benchmark, and improve the financial health and resilience of their customers, employees, and communities. By partnering with us, these organizations accelerate innovation in their programs and services, leading to tangible improvements in customer loyalty, financial outcomes, and social outcomes.

Our Services

The Challange

That Financial Vulnerability Brings

Financial vulnerability and financial stress are mainstream issues affecting Canadians of all income levels and in particular more vulnerable populations. Check out this video for more context around why we’re working to help improve financial resilience for all.

Are You

Looking To Have An Impact?

As of February 2024:

Join

Organizations Sharing Your Values

Recognize any of these brands.

All of them have worked with us,

click on each logo to learn more.

The Institute is partnering with Co-operators on a multi-phase enterprise-wide financial resilience project, to help the financial services organization to measurably improve the financial resilience and financial security of its clients and communities in line with its purpose. This work involved quantitative and qualitative research analytics, impact measurement, strategy and innovation, with our team working closely with Co-operators’ senior leaders, advisors, clients and an Advisory Group.

Data and research analytics is a team sport. Financial Resilience Institute (previously Seymour Consulting) and Statistics Canada have collaborated to publish a joint report on the financial resilience and financial well-being of Canadians during the COVID-19 pandemic, with the leading government statistical office having peer-reviewed the Seymour Financial Resilience Index TM.

Some People

Say The Nicest Things