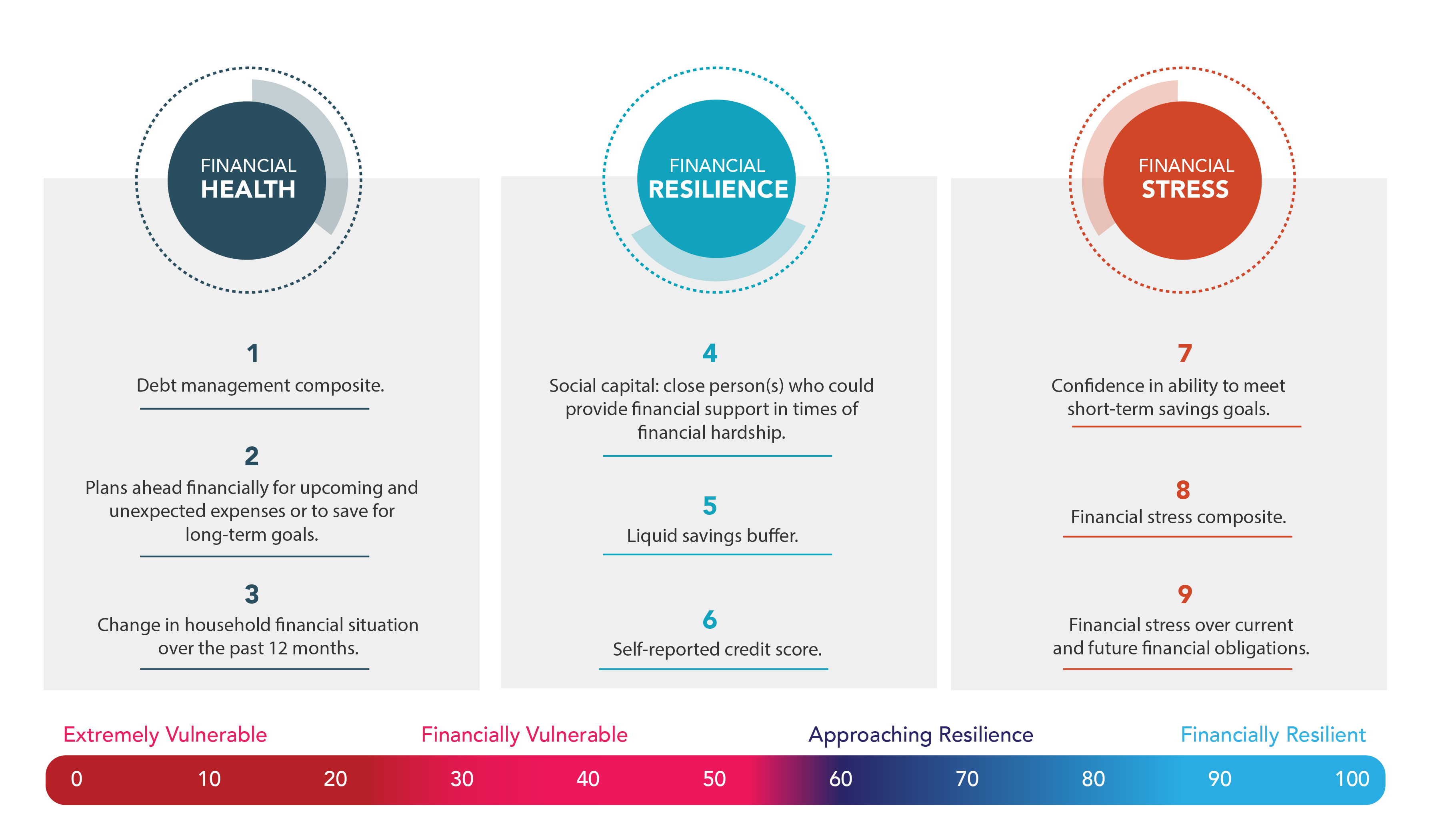

Indicators and Scoring Model

Seymour Financial Resilience Index®

Households’ financial resilience is based upon nine behavioural, resilience and sentiment indicators. These include a liquid savings buffer, level of financial stress over current and future financial obligations, social capital, confidence in ability to meet short term savings goals, a debt management composite indicator, a person’s self‐reported credit score and other indicators outlined above.

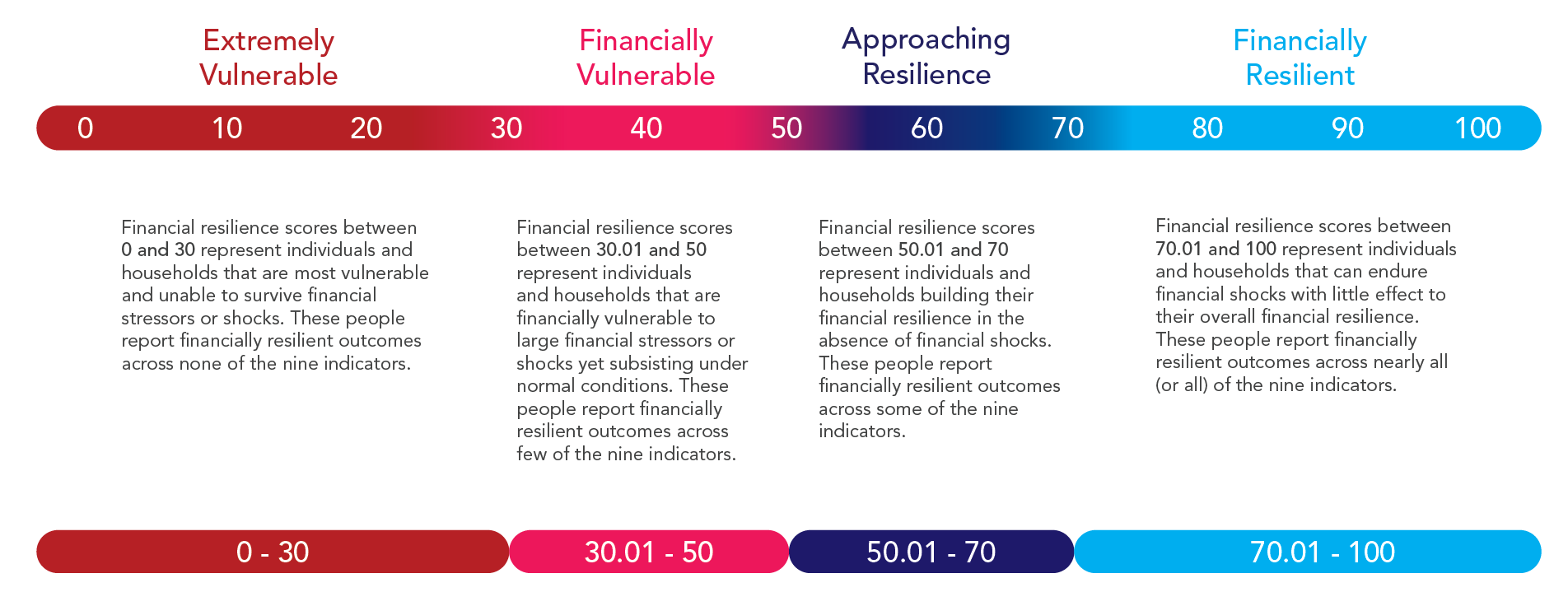

Based on the indicators, households are scored from 0 to 100 in terms of their household’s financial resilience. ‘Extremely Vulnerable’ households have a financial resilience score of 0 to 30, ‘Financially Vulnerable’ a score of 30.01 to 50, ‘Approaching Resilience’ a score of 50.01 to 70 and ‘Financially Resilient’ households have a score from 70.01 to 100. Weightings for the index indicators are not equal.

Financial Resilience Segments

Households from all household income demographics are represented across all four financial resilience segments. In other words, you can have a household income of $150,000, but be ‘Financially Vulnerable’. Below is the distribution for Canada based on the February 2024 Index.

People’s financial resilience scores can improve or deteriorate within a few months — as they adjust their behaviours or are impacted by life events, stressors or shocks.

Contact us for more information.