About the Institute’s Financial Resilience Index Model

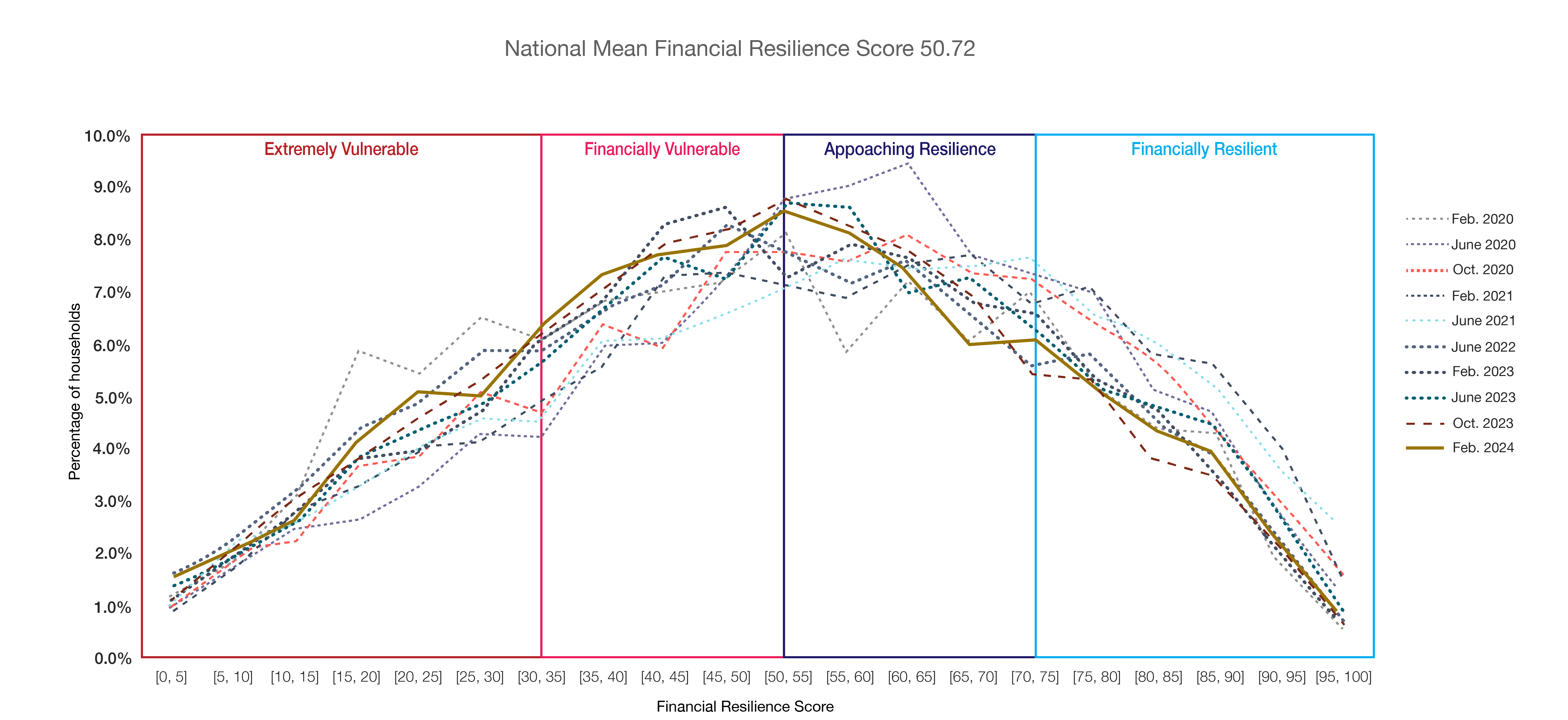

Index Distribution from February 2020 to February 2024

The Seymour Financial Resilience Index® measures and tracks households’ financial resilience in Canada. Household financial resilience is defined as a household’s ability to get through financial hardship, stressors and shocks as a result of unplanned life events.

Consumers’ financial resilience is measured at the national, provincial, segment and individual household levels across nine behavioral, sentiment and resilience indicators.

The Index has been peer-reviewed by Statistics Canada, C.D. Howe Institute, UN-PRB, Haver Analytics, and Financial Institutions and organizations using the Index. It is being used for research, impact measurement and has multiple applications. It can also be applied to other countries. The Index builds on over seven years of longitudinal national Financial Well-Being studies data and measures household financial resilience policymakers, bank customers and any organization using the Index and accessing the Institute’s independent longitudinal benchmark data.

Find out more here about the Index development methodology and indicators and scoring model or contact us for more information.

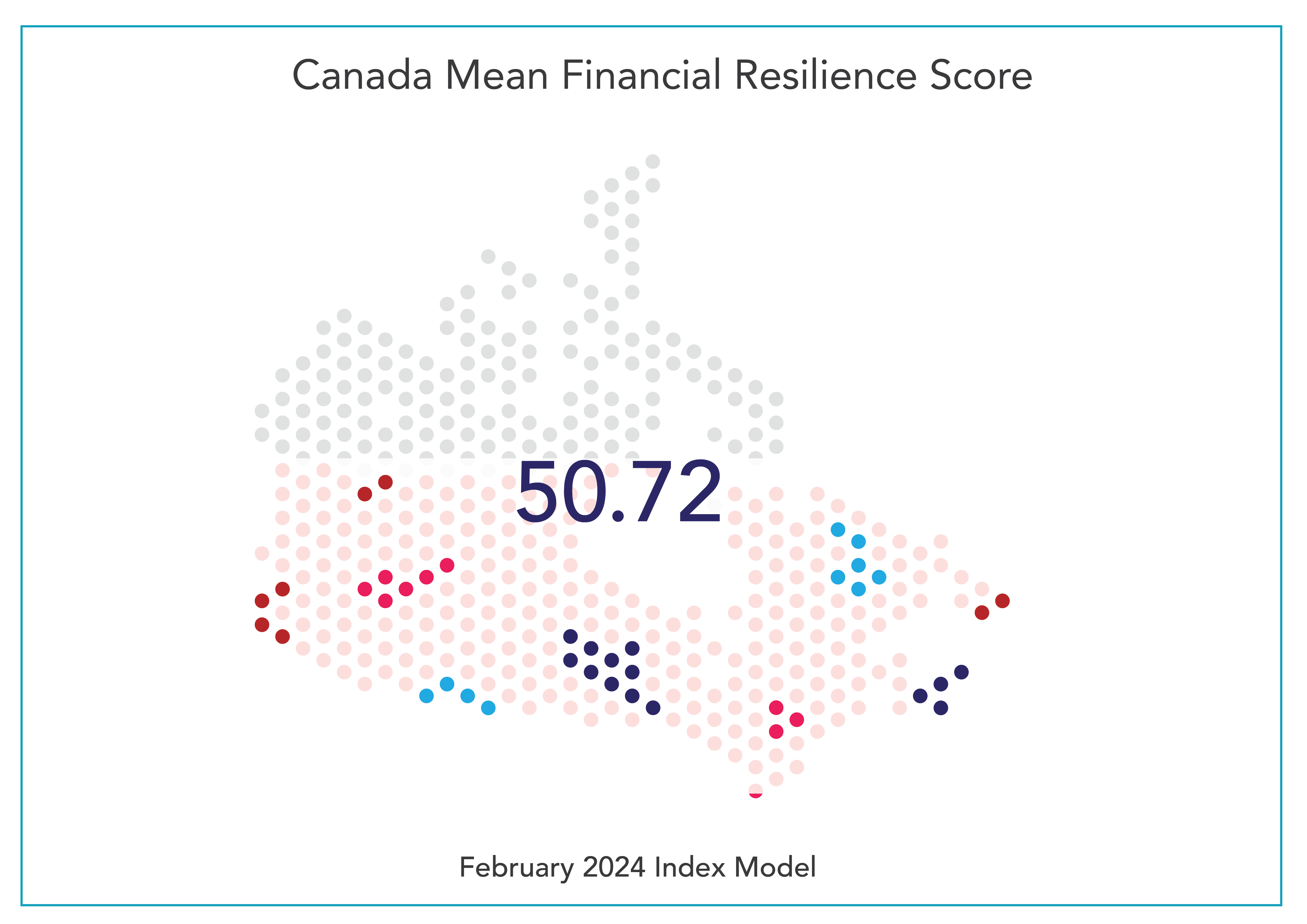

National

The Index measures’ households’ financial resilience, and the mean financial resilience score for Canada, with the Canada mean financial resilience at the national level 55.67 based on the June 2021 Seymour Financial Resilience Index®. This means that at the national level, Canadians are “Approaching Resilience”.

Provincial

Financial resilience measurement, analytics and tracking is available at a provincial level for comparative purposes. Provincial comparisons allow for national organizations to see provincial disparities within their markets and client bases.

Segment

Financial resilience and financial stress, health and well-being measurement, analytics and tracking is available for many consumer segments and sub-segments. These include for example: Millennial renters; Indigenous Canadians; tier-one bank customer mortgage holders with good or fair self-reported credit scores and others. This allows organizations to understand the financial resilience of their target customers and prospects with multiple applications.

Organization

Financial resilience measurement and analytics is available for tier one Canadian banks and other organizations, enabling long-term impact measurement and customized financial resilience (and vulnerability) scoring at the organizational, portfolio or segment level for their organization. Customized studies and boost samples enable all types of organizations to measure their customers, employees or communities’ financial resilience and track this over time.

Individual Household

Financial resilience scoring and analytics is available for individual households, existing or prospective customers. Contextualized scores and analytics provided against the Index and longitudinal benchmark data with customized solutions and applications for organizations based on their needs. Contact us for more information if this is of interest for your organization.