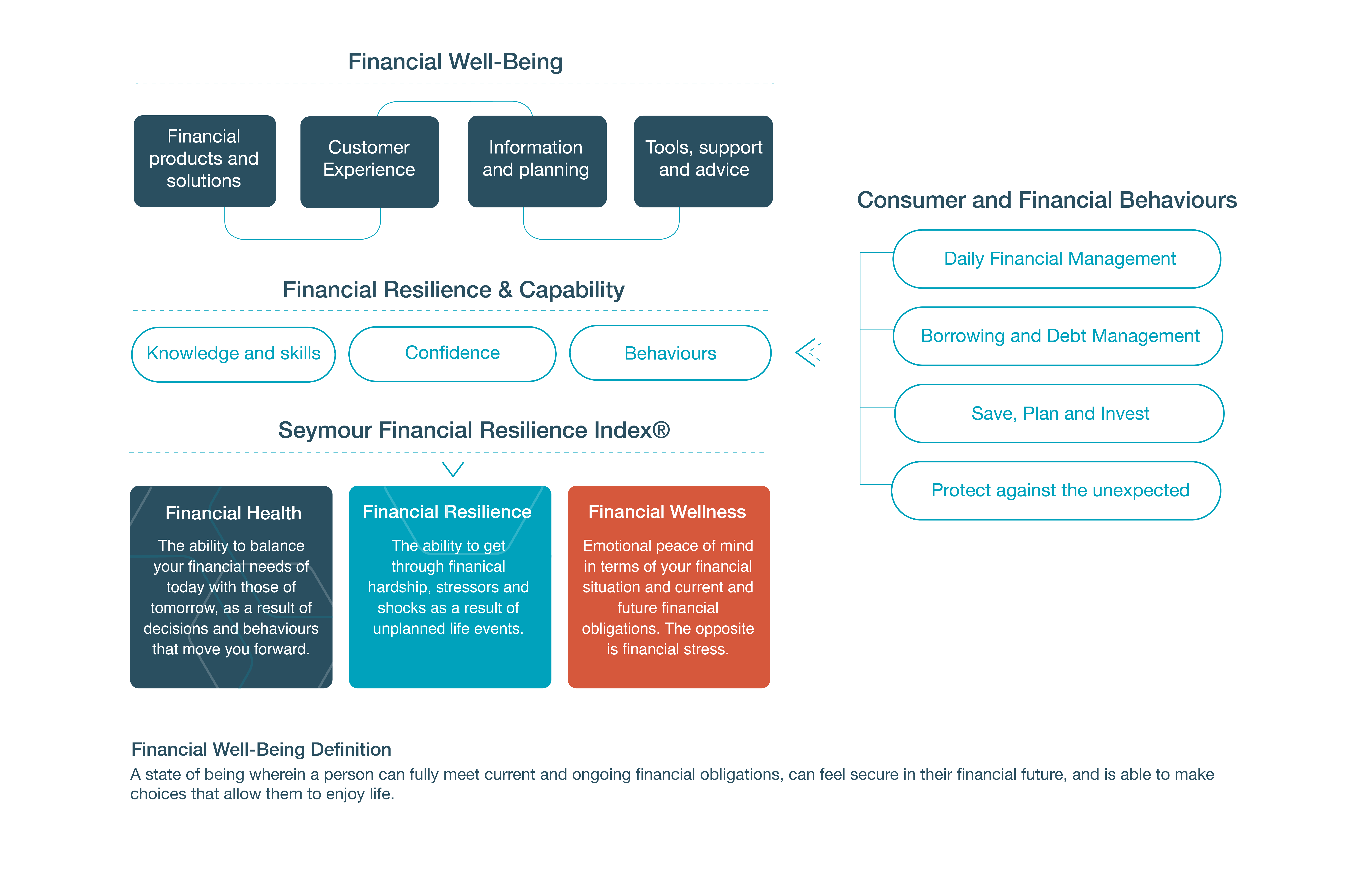

Definitions of financial health, financial resilience and financial wellness

Financial Health

The ability to balance your financial needs of today with those of tomorrow, as a result of decisions and behaviours that move you forward.

Financial Resilience

The ability to get through financial hardship, financial stressors or shocks as a result of unplanned life events.

Financial Wellness

Emotional peace of mind in terms of your financial situation and current and future financial obligations. The opposite is financial stress.

Financial Well-Being Framework

The Financial Well-Being Framework has been peer-reviewed by many leading academics, organizations and financial health leaders around the world. It forms the foundation for the Financial Well-Being studies and Institute’s Financial Resilience Index model.

Independent tracking is provided on the extent to which tier one bank customers (and the customers of any organizations working with the Institute) rate their FI or organization for helping to improve their financial wellness over the past year. We are also tracking the financial vulnerability and challenges of key populations facing systemic barriers and many social and financial challenges including food insecurity, housing affordability, climate change impacts and more.