About the Seymour Financial Resilience Index®

What the Index Measures

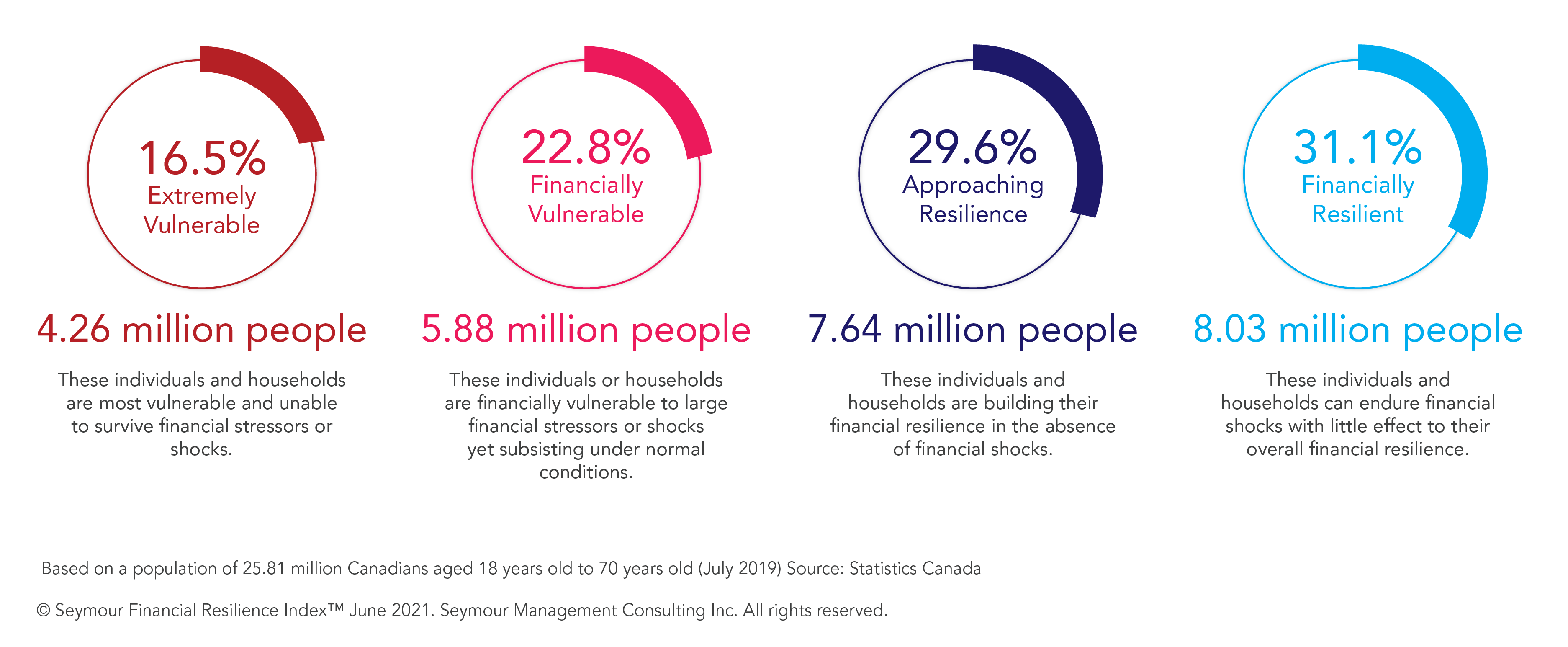

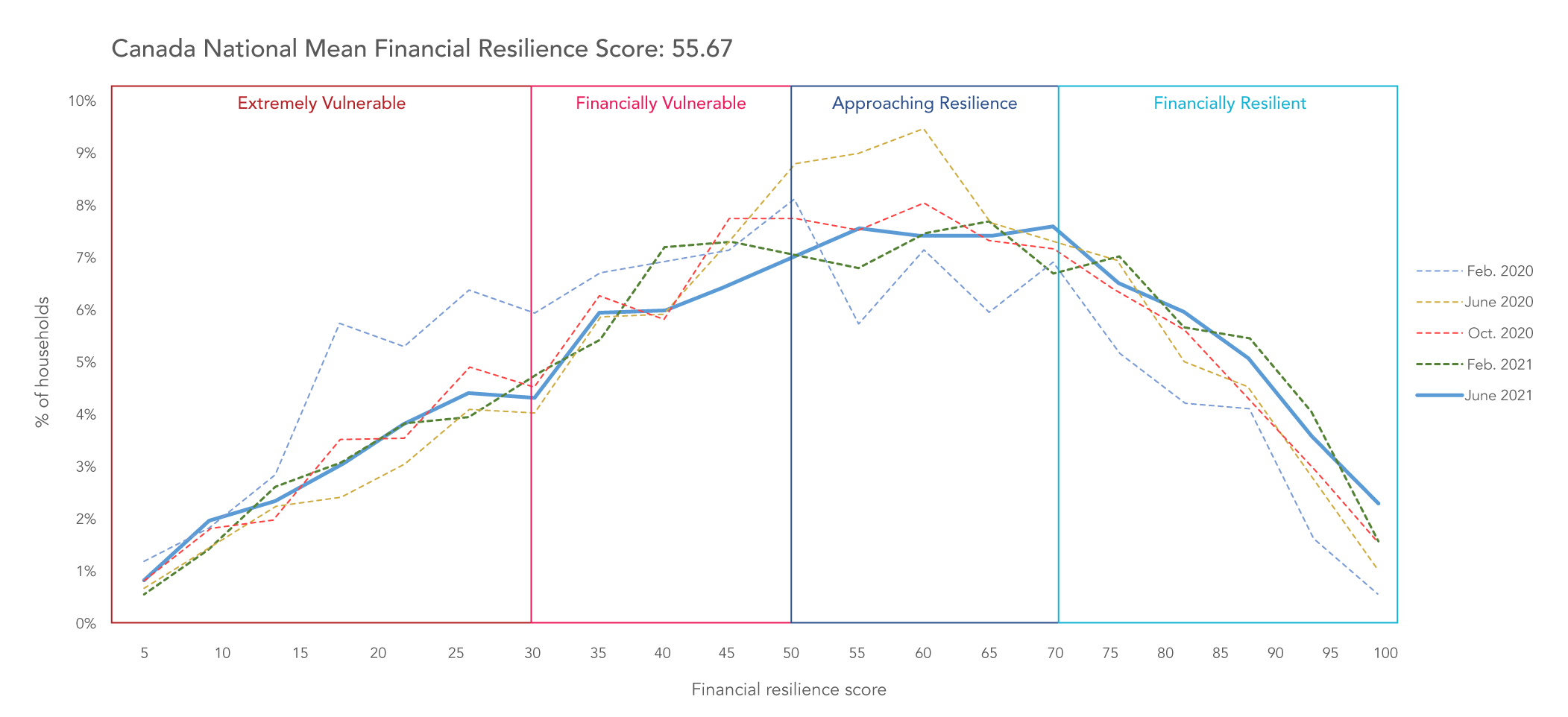

The Seymour Financial Resilience Index® measures a household’s ability to get through financial hardship, stressors and shocks as a result of unplanned life events. It measures and tracks households’ financial resilience of Canadian households at the national, provincial, segment and individual household levels, with an Index baseline of February 2020 (pre-pandemic).

Peer reviewed by Statistics Canada and the C.D. Howe Institute the Index builds on over five years’ of national longitudinal data for Canada, and is the first Index of its kind in the world. It enables the measurement and tracking organizations’ financial resilience (and financial vulnerability) over time, with multiple applications. Financial resilience measurement can be provided at multiple levels, including for individual customers. In addition, financial resilience scoring is available for Canada’s tier one banks, along with independent tracking on the extent to which their customers (and more financially vulnerable segments) rate their FI for helping to improve their financial wellness.

The Index can also be used by other organizations, also as a complementation and augmentation to the credit score. Find out more on benefits and applications for Financial Institutions specifically. [insert link to brochure, which I’ll send you Monday]

The Index is complemented with wider data from the longitudinal Financial Well-Being studies for Canada launched by Seymour Consulting to measure Canadians’ financial stress, financial health and financial well-being on an on-going basis, since 2017. Households’ challenges in terms of access to financial products, services, information, support and advice are tracked for Canadians and specific populations, along with reported consumer and financial behaviours and more. Seymour also provides independent tracking on the extent to to which tier-one bank customers rate their primary FI for helping to improve their financial wellness, with many applications for the Index and this data to complement organizations’ internal data and analytics.

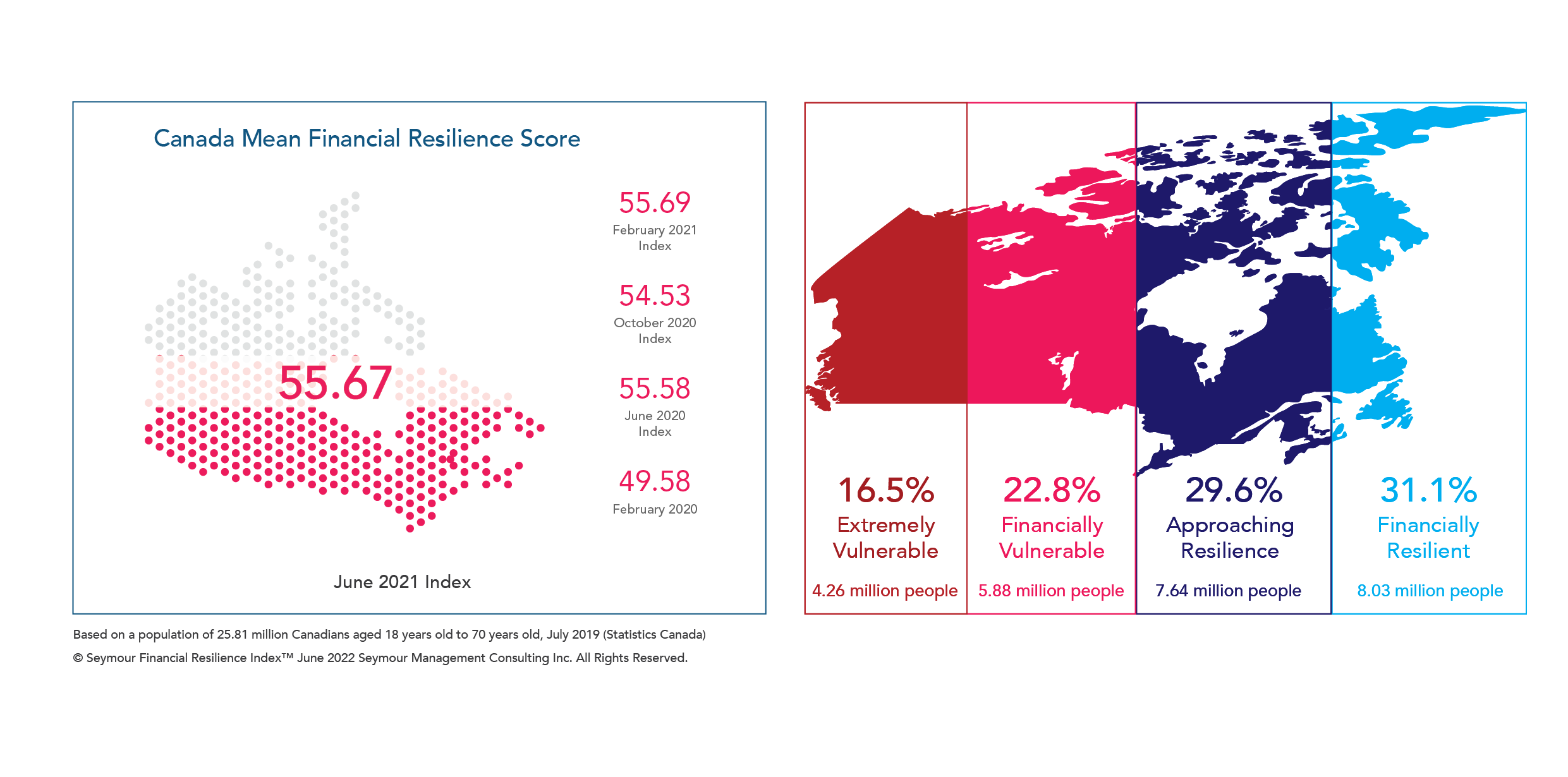

Based on the June 2021 Index, the mean financial resilience score for Canada is 55.67. The next Index will be June 2022, with some changes expected as a result of the inflationary environment and post-pandemic environment affecting many Canadians.

Original Index Release Report

Statistics Canada - Seymour Consulting Report

February 2021 Index Release Summary

Index Benefits for Financial Institutions

© Seymour Financial Resilience Index™. Seymour Management Consulting Inc. All rights reserved.

Index Development Process and Model

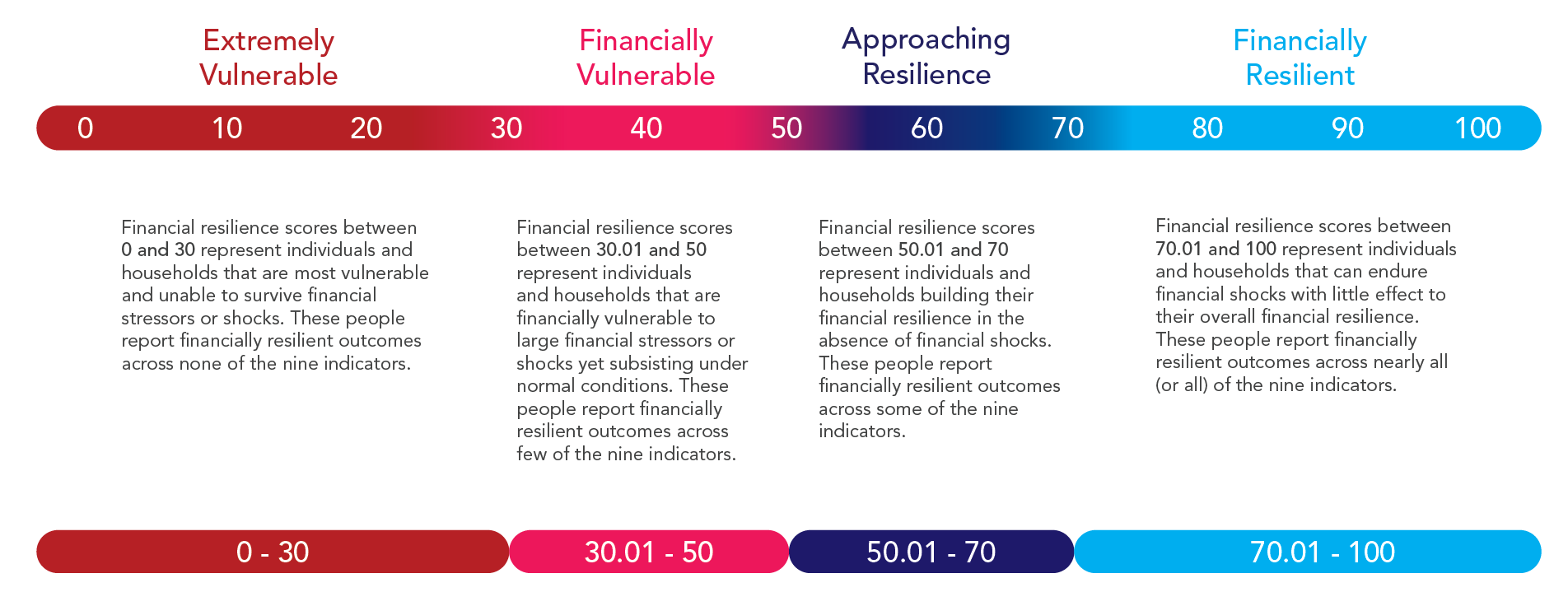

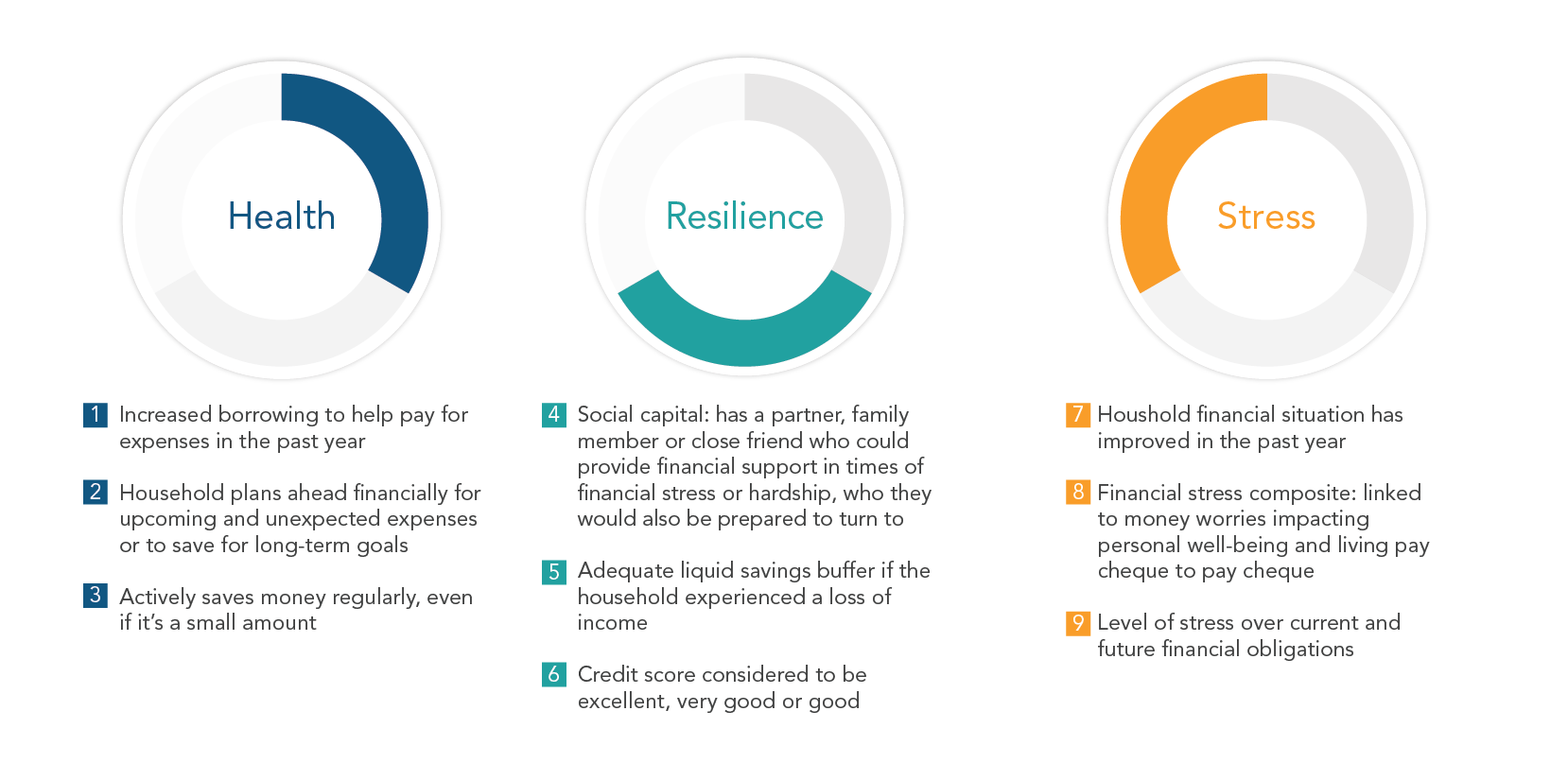

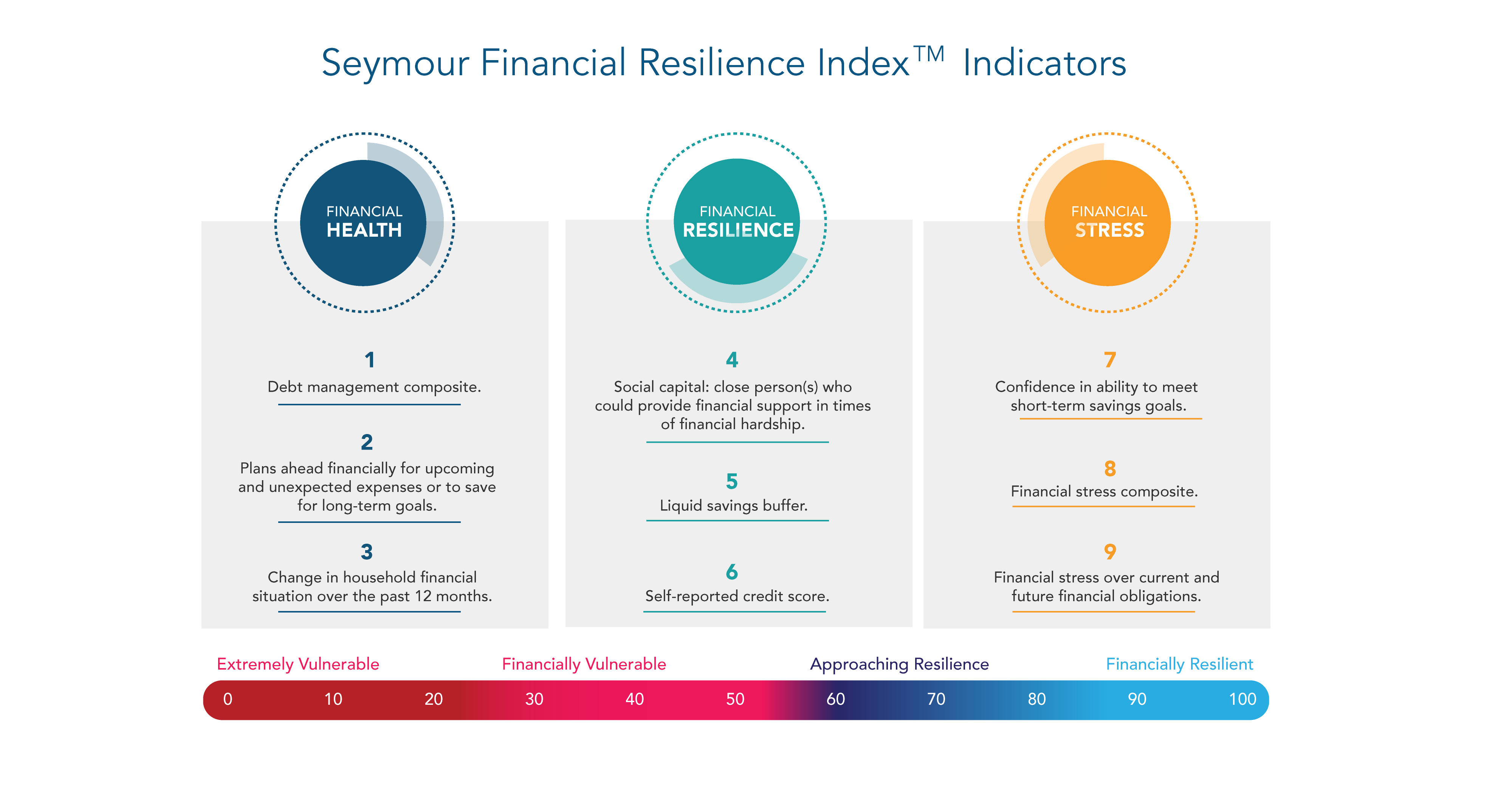

The Index was developed over five years based on an iterative process to regressing and evaluating over 30 potential indicators against self-reported “financial resilience” or “financial stress” measures using the multiple linear regression technique. In the end, nine variables were determined to account for 57 percent of the variance in the financial resilience construct as of June 2021 and 64 per cent of the variance in the financial resilience construct as of February 2021. The regression model has indicators which are significant at a 95% confidence interval, meaning that their p-values are less than 0.05.

The regression model was validated against 2017, 2018 and 2019 survey data, which revealed consistency in results, represented both by a strong R-squared as well as similar weights of the independent variables as predictors of financial resilience. Note: weightings for the model are based on their overall contribution to the dependent variable in the model and are not equal.

Based on 2017 and 2018 data, six out of the nine index model independent variables were available, and in the 2019 data 7 of the independent variables were available. All 9 variables including the composite variable are available based on the 2020 data for February 2020. There were four stages of index development and validation:

1] Identification of potential indicators

2] Data collection for Index development

3] Indicator selection and

4] Model Validation.

The Index has been peer-reviewed and validated by organizations such as Statistics Canada and leading Financial Institutions and is a highly robust model.

Index Applications and Benefits

The Index has multiple applications with the ability for customized sample boosts and scoring for organizations based on their business needs. The next Index will be based on June 2022 data, with a representative sample of 5000 households based on household income, age, gender and province. Data is collected through the longitudinal Financial Well-Being study [2017-2022] with end-to-end analytics conducted by Seymour Consulting. Online respondents are recruited through the Angus Reid Forum, Canada’s most respected online panel.

Index data and analytics can be combined with organizations’ transactional data and other and help inform strategies and action plans to help your organization to improve the financial resilience and financial wellness of your customers at scale. Customized questions and analytics is often provided to support your organization’s unique needs and goals.

Take a look at the Benefits for different stakeholders here.