Problem We Are Trying To Solve

Growing financial vulnerability and financial stress are mainstream issues in Canada many countries globally. This has many knock-on effects linked to financial and economic stability; health, quality of life, well-being, productivity, inclusive growth and resilience. Consumers’ financial well-being, financial health and financial resilience is rising on global policy agendas as countries confront economic volatility and increased household vulnerability.

Financial health increasingly recognized as a factor contributing to financial stability, financial well-being, inclusive growth, resilience building and other aspects of individual and societal well-being. In the financial sector, the financial health and resilience of customers and employees contribute to the sustainability, profitability and stability of financial institutions.

When individuals thrive, so do families, small businesses and the economies

In view of important connections with growth and stability, there is a growing interest from financial sector authorities, regulators, supervisors, governments, financial institutions, employers and innovators in understanding and advancing financial health and resilience at the household and macro levels.

Financial health impact needs cross-sector collaboration

By better understanding financial resilience, more nuanced fiscal, monetary, financial and social policy levers, policies and programs can be developed to help drive positive financial resilience outcomes with a sharpened aim at specific underserved and more vulnerable populations.

Planned and unplanned life events, stressors and shocks have effects at multiple levels, with financial resilience and financial well-being enablers of overall resilience, health and thriving communities.

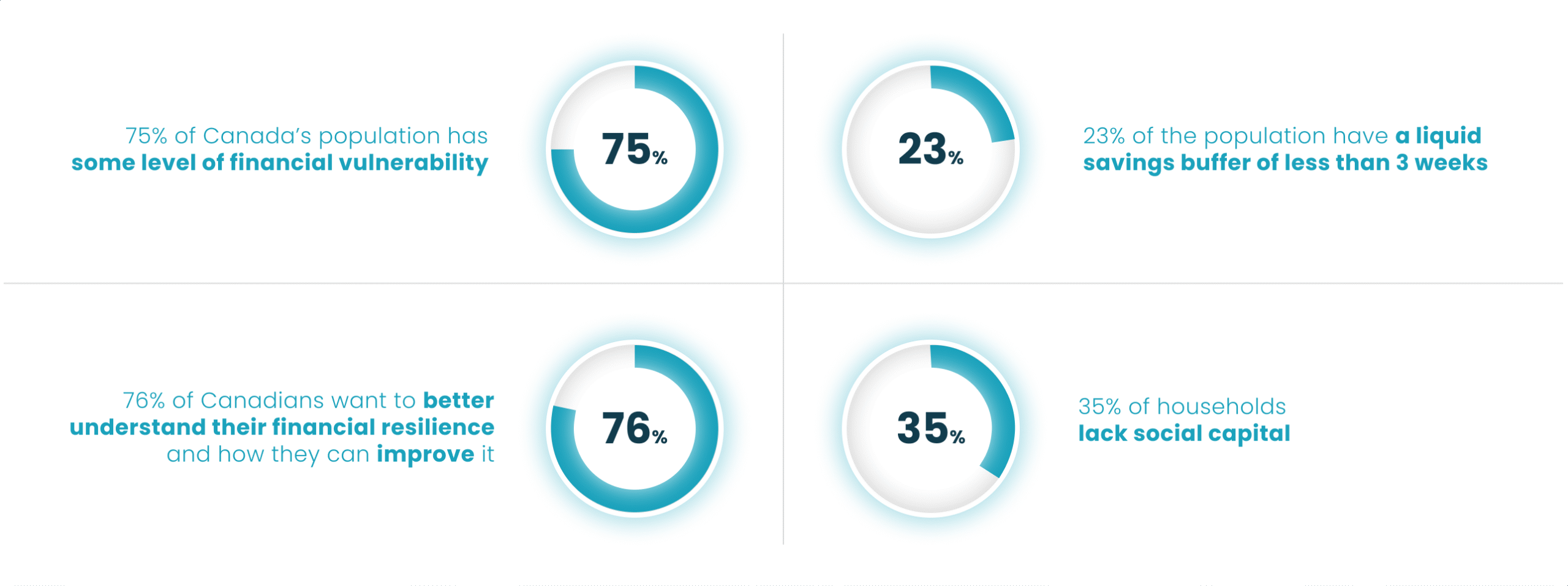

The financial vulnerability of Canadians

As of October 2025:

Did you know that 75% of Canadians have some level of financial vulnerability?

According to our peer-reviewed Index model, that’s just over 19 million people that are vulnerable to financial stress and hardship. 18% of the population, representing 4.5 million Canadians, are ‘Extremely Vulnerable’. This data is from the Institute’s October 2025 Financial Resilience Index model, based on a sample size of 5814 Canadians.

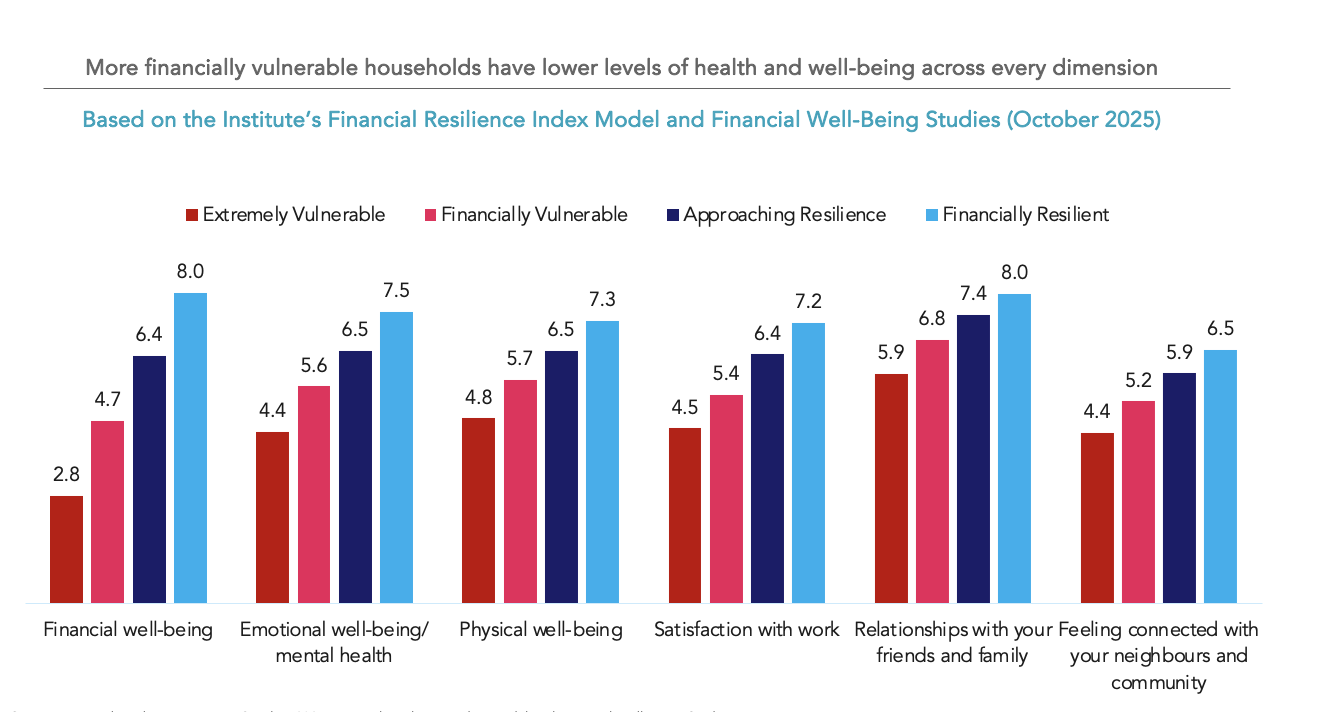

Clear links exist between financial well-being and overall health and well-being

More financially vulnerable households based on their financial resilience segment have lower levels of financial well-being and all well-being dimensions in October 2025, as in previous years.

- 68% of people report money worries impact their mental health

- 44% say money worries make them physically unwell

- 43% report money worries impact their productivity or performance at work

- 69% say money worries cause emotional stress

More financially vulnerable households have lower levels of financial well-being and all well-being dimensions: with this the social impact case for Policymakers and others working to help improve financial resilience and financial well-being. See our joint report with Statistics Canada published in 2021 with linkages to the government’s Quality of Life Framework.

By better understanding financial resilience, more nuanced fiscal, monetary, financial and social policy levers, policies and programs can be developed to help drive positive financial resilience outcomes with a sharpened aim at specific underserved and more vulnerable populations.

Planned and unplanned life events, stressors and shocks have effects at multiple levels, with financial resilience and financial well-being enablers of overall resilience, health and thriving communities.

Find out more through accessing data and reports on, for example, economic inclusion and mobility, climate change impacts on household financial vulnerability or protection as a pathway to financial resilience.