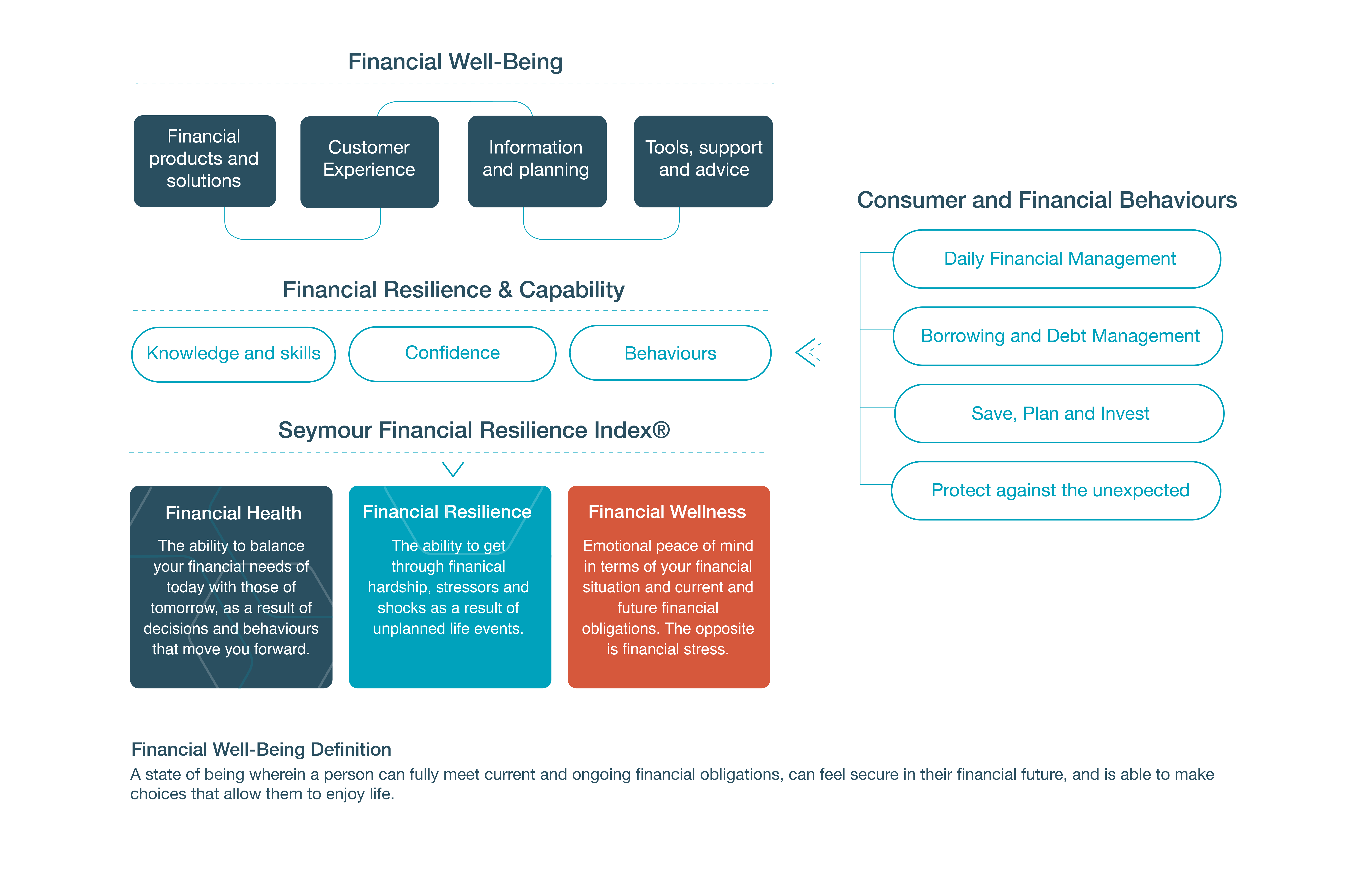

Definitions and a holistic lens on Personal Financial Well-Being

Personal Financial Well-Being Framework

The Personal Financial Well-Being Framework provides a holistic view of the complex multi-dimensional construct of an individual’s financial well-being. It was developed based on extensive desk research, quantitative and qualitative research analytics, consumer consultations and peer-reviews by leading academics, financial health experts and financial institution leaders around the world. The Framework provides the foundation for the Financial Well-Being studies instrument launched in 2017, with application across many countries.

This framework includes definitions, indicators, and connections between the inter-related constructs of financial health, financial resilience, financial wellness, and financial capability which together impact an individual’s financial well-being. The framework has a focus on individual consumer and financial behaviours that impact individuals’ financial well-being across the spectrum of daily financial management, saving, planning, and investing, debt and credit management and protection. These are tracked in the context of the consumers’ lives and their financial health decisions over the short, medium and longer term. Reported objective and subjective consumer and financial behavioural indicators are tracked and can combine with and complement consumers’ Financial Institution(s) banking transactions or other data as appropriate.

The framework encompasses financial services enablement support that consumers can put in place themselves and/or Financial Institutions (or other organizations) can offer. These include financial products, solutions, access to and delivery of credit, financial education, digital tools and more. From an enablement perspective, programs and interventions from Policymakers, Employers, Non-Profit organizations and others can help to support consumers, employees and families’ financial well-being. Consumers’ financial inclusion and access-to-financial help challenges are measured and tracked as part of the holistic framework.

More information and insights around the Financial Well-Being Framework, forming the foundation for the Financial Well-Being studies instrument is available below:

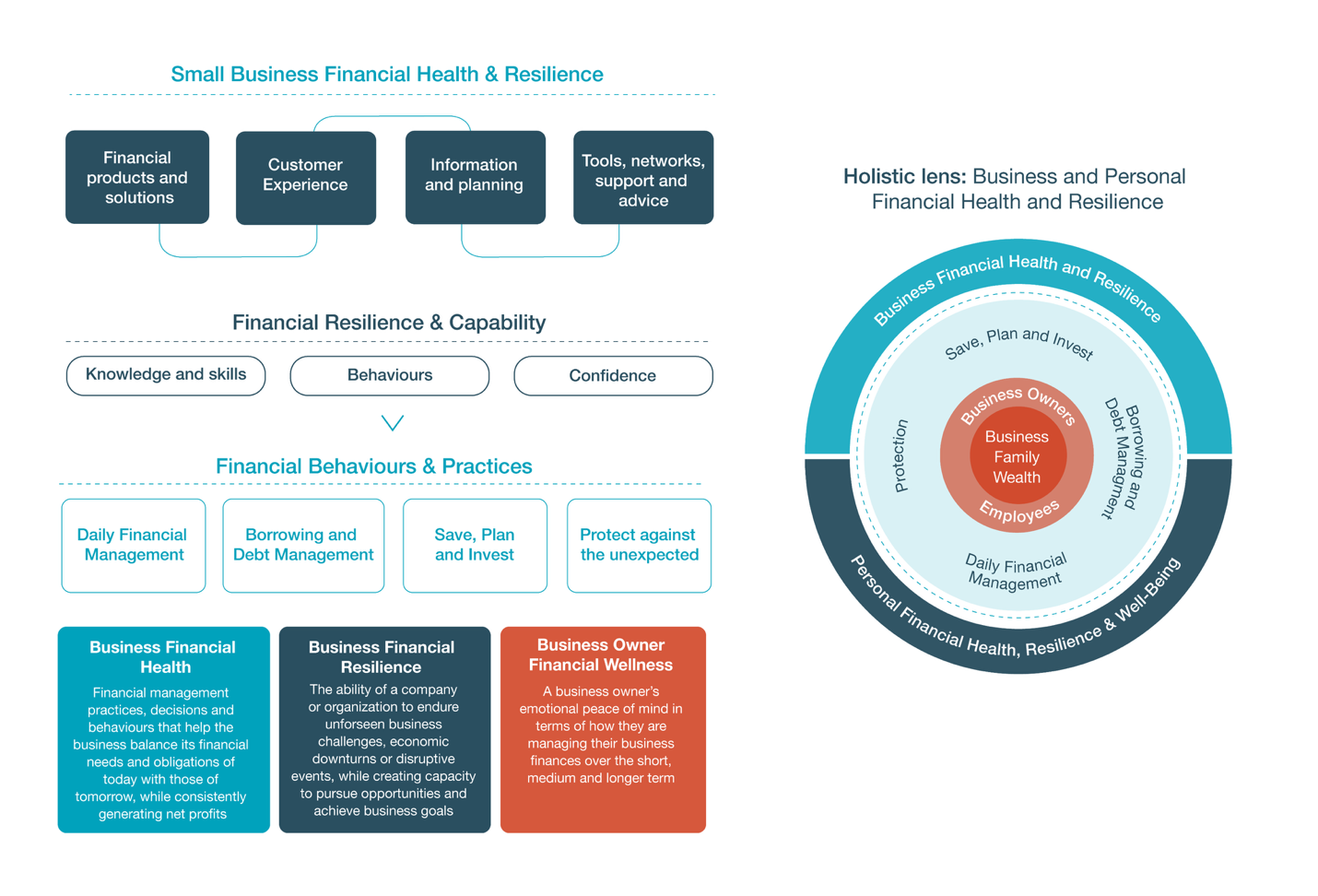

Small Business Financial Health and Resilience Framework

Small and Medium Sized Enterprises (SMEs) are an integral part of many of the economies around the world. These businesses stem job creation, drive innovation and contribute to GDP growth. Financial Resilience Institute recognizes this and the intense need to better understand and aid entrepreneurs in ensuring strong financial health and resilience for SMEs globally.

The proprietary Business Financial Health and Resilience Framework provides a framework for analysis of the financial health and resilience of Small and Medium Sized Enterprises (SMEs) and the relationship with the respective business owner’s personal financial health, financial resilience and financial wellness.

The framework focuses on business financial practices and behaviours across the spectrum of daily financial management, cashflow management, saving, planning, and investing (including succession planning), borrowing, debt management, and protection. It brings a holistic lens and set of indicators related to business financial health, financial resilience and business owner financial wellness. It brings a holistic lens on the business and personal financial health and resilience of a SME business; the business owner, their family and employees as appropriate.

The framework was developed over ten years by Eloise Duncan, CEO and Founder, Financial Resilience Institute. It has been informed by quantitative Business Financial Health Studies and research from the US, Canada, India and other countries; several qualitative consultations with Business Banking experts and SME bank customers in Canada [1,2]. In addition, the framework builds on the Personal Financial Well-Being Framework developed in 2016 [3].

For more data and insights around SME financial health and financial resilience, check out our Small Business Financial Health and Resilience Report.

Source: Financial Resilience Institute, Business Financial Health and Resilience Framework

[1] ‘Business Financial Health and Resilience Framework’ refers to a model developed by Seymour Management Consulting Inc. in 2021 and licensed by Financial Resilience Society (dba Financial Resilience Institute). This provides a framework for analysis of the financial health and resilience of Small and Medium Sized Enterprises (SMEs) and the relationship with the respective business owner’s personal financial health, financial resilience, and financial wellness. The framework focuses on business financial practices and behaviours across the spectrum of daily financial management, cashflow management, saving, planning, and investing (including succession planning) borrowing, debt management, and protection.

[2] ‘Financial Well-Being Framework’ refers to a proprietary framework developed by Seymour Management Consulting Inc., used under license by Financial Resilience Society, with this outlined on page 107. The framework provides a holistic view of the complex construct of an individual’s financial well-being. It includes definitions, indicators, and connections between the inter-related constructs of financial health, financial resilience, financial wellness, and financial capability which together impact an individual’s financial well-being. The framework has a focus on individual consumer and financial behaviours that impact individuals’ financial well-being across the spectrum of daily financial management, saving, planning, and investing, debt and credit management and protection. The framework is published on the Institute’s website at: https://www.finresilienceinstitute.org/definitions-financial-well-being-framework/