The Business Financial Health and Resilience of SMEs and Women-Owned SMEs in India Report

Advancing Gender Equality and Empowerment, Financial Inclusion and Resilience

This ground-breaking report is published by non-profit Financial Resilience Institute as we work to help improve financial resilience and well-being for all.

This report, published by Financial Resilience Institute in October 2025, was made possible thanks to the support of Standard Chartered as a WE-Finance Code Global Signatory. The report aligns with work by Standard Chartered and others to advance gender equality and empowerment and financial health and inclusion for Small and Medium Businesses (SMEs).

This market-leading report aims to share data and insights on the small business financial health and resilience of SMEs in India, and in providing insights from a disaggregated gender lens perspective for Women-Led SMEs. See our press release for more information on the launch of this report.

Within the report are numerous key business financial health, financial resilience and business owner financial wellness indicators, of relevance across many markets. The report is focused on providing insights for Financial Institutions focused on sustainable finance and lifting up women entrepreneurs and Women-Owned SMEs.

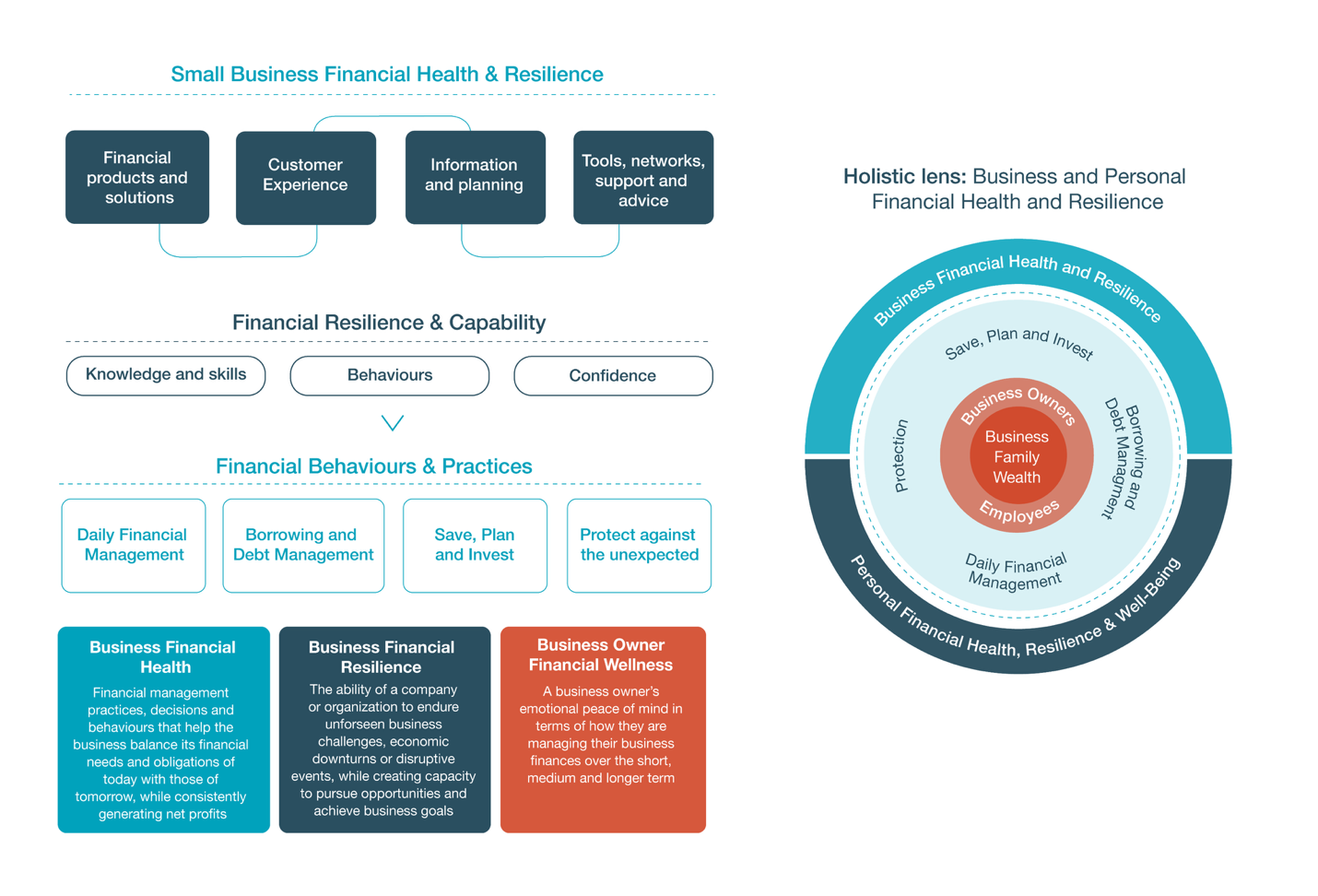

The report marks the first time publishing the Institute’s Small Business Financial Health and Resilience Framework. More information on the framework and its uses is available here.

Definitions of SMEs and Women-Owned SMEs

There are different definitions of Small and Medium Size Enterprises (SMEs) in different countries and markets, with no one single definition. For the purposes of this study, SMEs are defined as businesses with annual revenues between $US 100,000 US and $US 2 million operating in India, excluding start-ups that have been in business for less than one year. All SME survey respondents are primary or joint financial decision-makers for their business.

Women-Owned or Women-Led SMEs are defined as businesses where a women owns a majority stake in the business of greater than 51% with this informed by the OECD and WE-Finance Code Guidance.

Disclaimer:

The report and indicators within build on non-profit Financial Resilience Institute’s Business Financial Health and Resilience Framework and gender-disaggregated data collected in India. The report is not designed to be a comprehensive report on the business financial health and resilience of SMEs in India or potential opportunities or implications for Financial Institutions and the ecosystem. Instead, it aims to share widely some example small business financial health and resilience indicators; key data based on the India Study with 409 SMEs in May and June 2025 and some example potential opportunities or implications for Financial Institutions wanting to serve SMEs and Women-Owned SMEs in India or other markets.