Household Financial Resilience Index

Seymour Financial Resilience Index ®

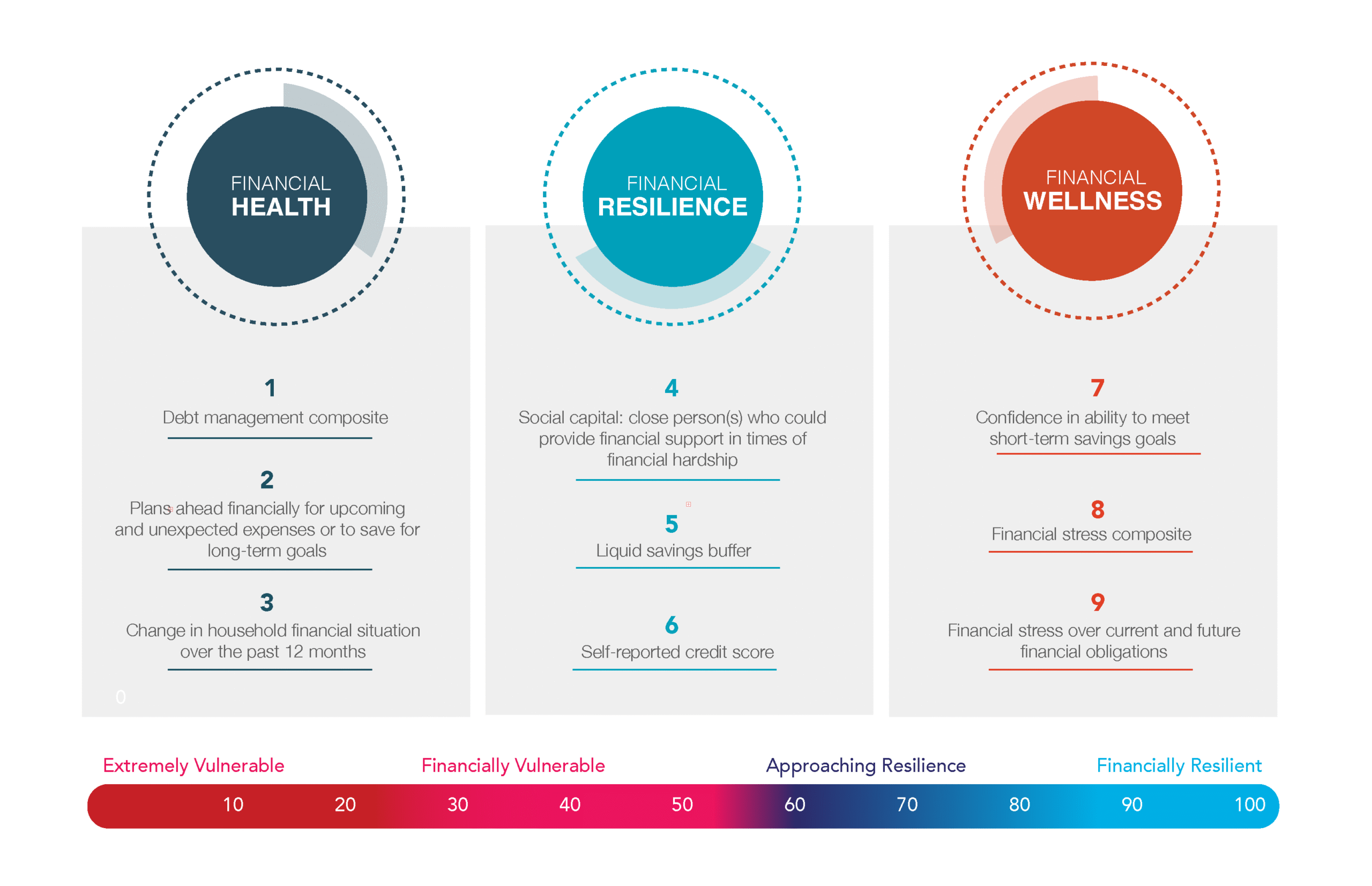

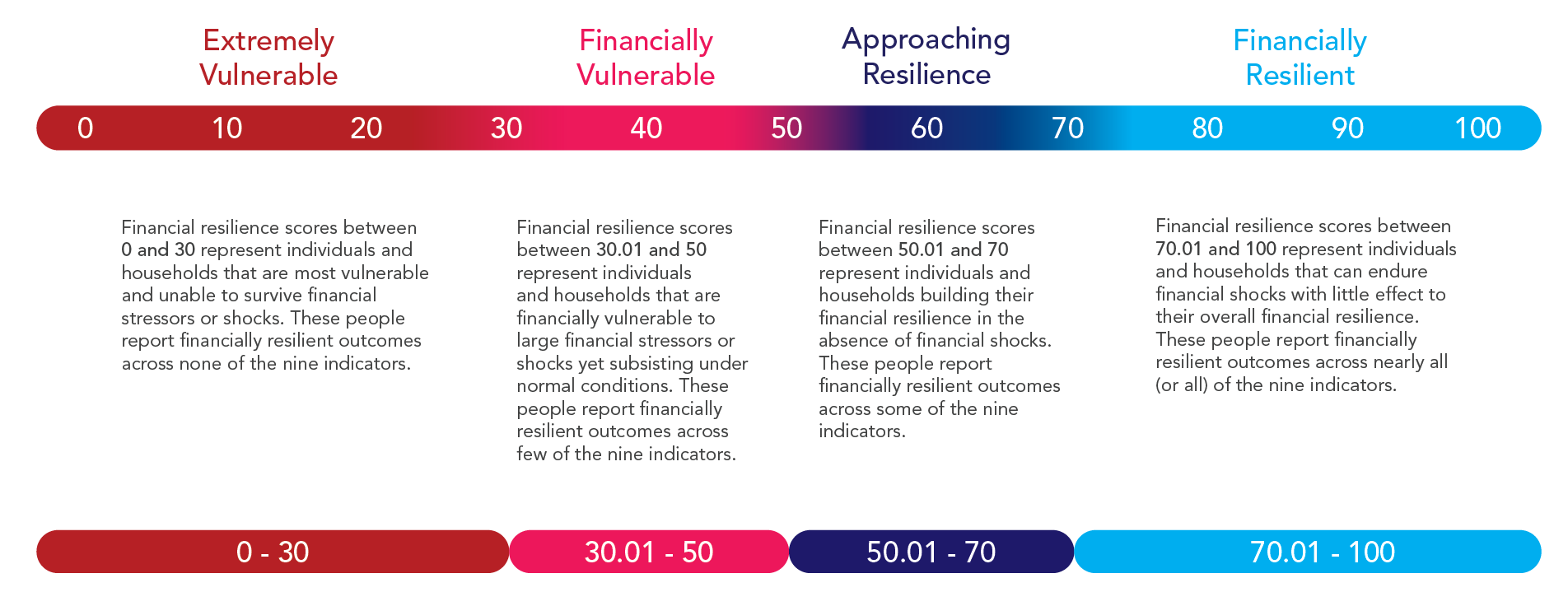

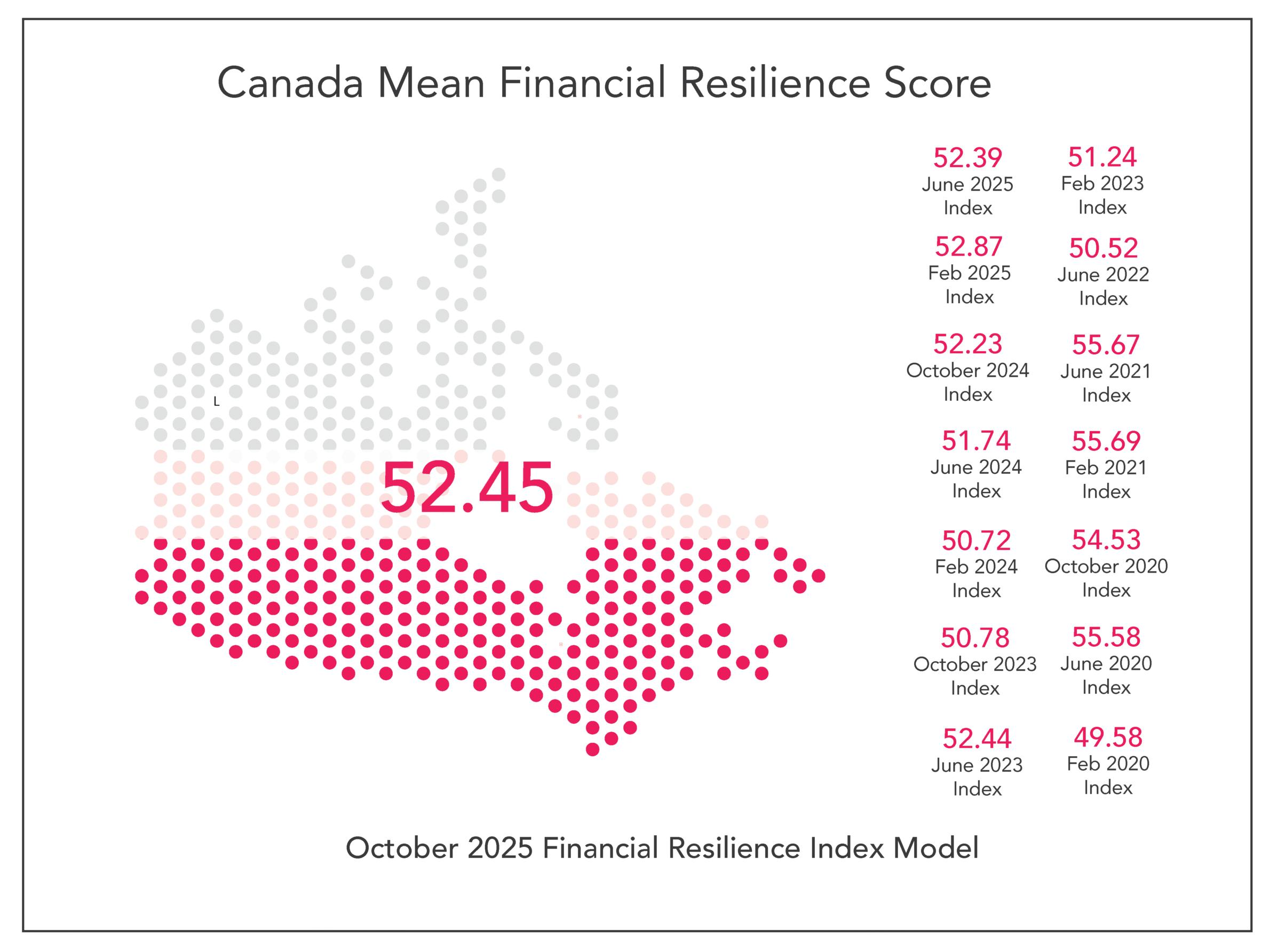

The Institute’s proprietary, peer-reviewed Financial Resilience Index Model is the world’s leading Index that measures household financial resilience in Canada. Financial Resilience is defined and measured as a household’s ability to get through financial hardship, stressors and shocks as a result of unplanned life events. The Index measures household financial resilience at the national, regional or provincial, segment and individual household levels across nine behavioural, sentiment and resilience indicators, with a pre-pandemic baseline of February 2020.

The Index is the first of its kind in the world, and measures household financial resilience for citizens, tier-one bank customers, employees and the stakeholders of any organization using it and working with the Institute.

Financial resilience is measured across nine behavioural, resilience and sentiment indicators based on the survey-based regression model. This builds on 10+ years of data from the complementary Financial Well-Being Studies instrument (2017-2025) and a rigorous development methodology process.

The Index has applications in many countries and complements macro financial stability and economic data and transactional data, providing a unique holistic lens on households to complement more traditional metrics such as income, assets, GDP, financial product holdings or debt-to-income ratios.

Index Indicators

Peer-Reviewed by Leading Organizations Globally

The Index has been peer-reviewed by many organizations and leading academics including but not limited to Statistics Canada, C.D. Howe Institute, UN-PRB, leading financial well-being academic Professor Kempson, IMF, World Bank, CGAP, UNSGSA, Haver Analytics, Vancity, Co-operators, Coast Capital, federal and provincial Government of Canada policymakers, Financial Health Network, Standard Chartered Bank, ING Bank, FP Canada, Prosper Canada, Victoria Foundation and others.

The Index has a pre-pandemic baseline of February 2020 and builds on 10 years of robust national financial health, stress and financial well-being data from the Financial Well-Being Studies (2017 to 2025) with customized questions added for clients and partners using it.

As of October 2025, the nine Index behavioural, sentiment, and resilience indicators explain 66% of the variance in the financial resilience construct. The model has remained consistently strong with all indicators having p-values of <.001.

Scoring Model

Index indicators are unequal and dynamic. This ensures the model is data-driven and unbiased, with the Institute not assigning weights based on assumptions. The Index reflects reality, so if the drivers of household financial resilience adjust in importance due to inflation, interest rate changes or consumer behavioural changes for example, this is reflected in the indicator weightings, enabling a powerful, dynamic model.

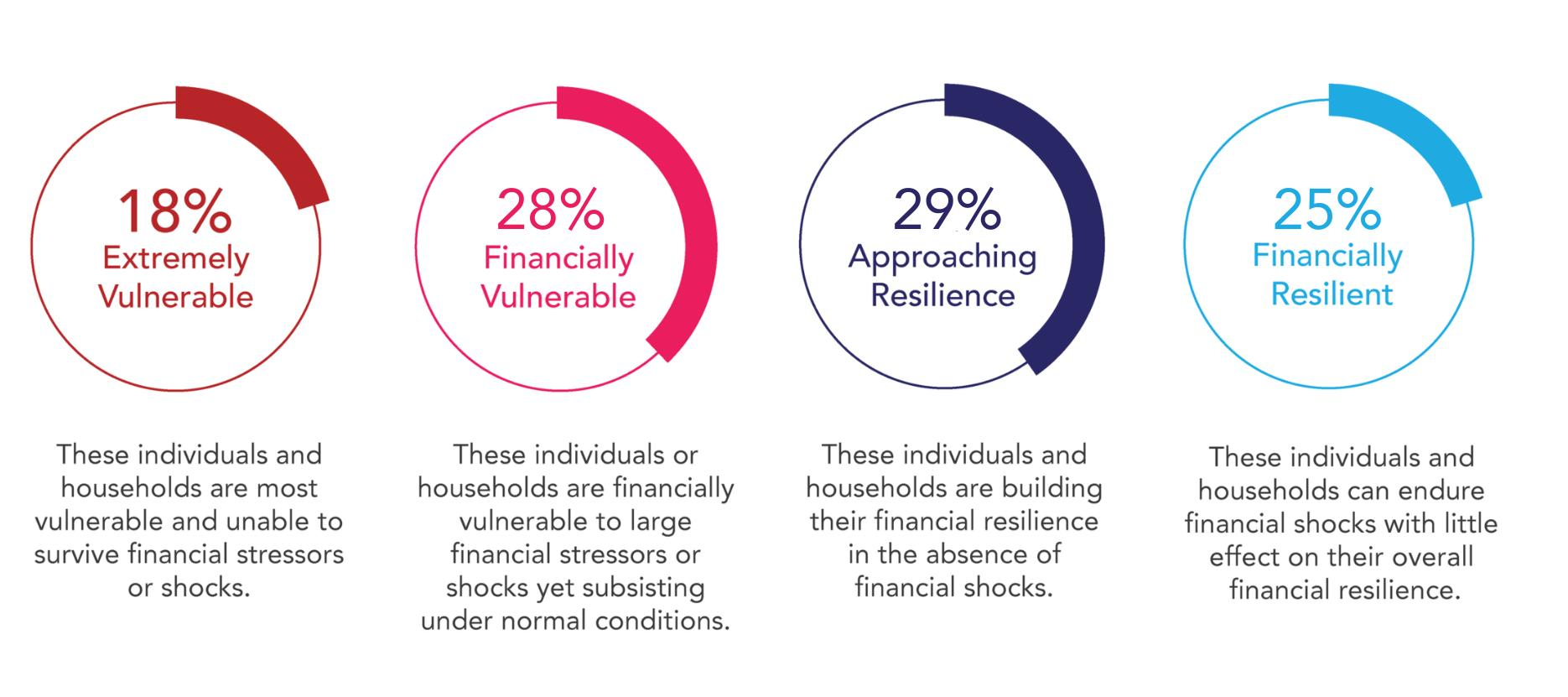

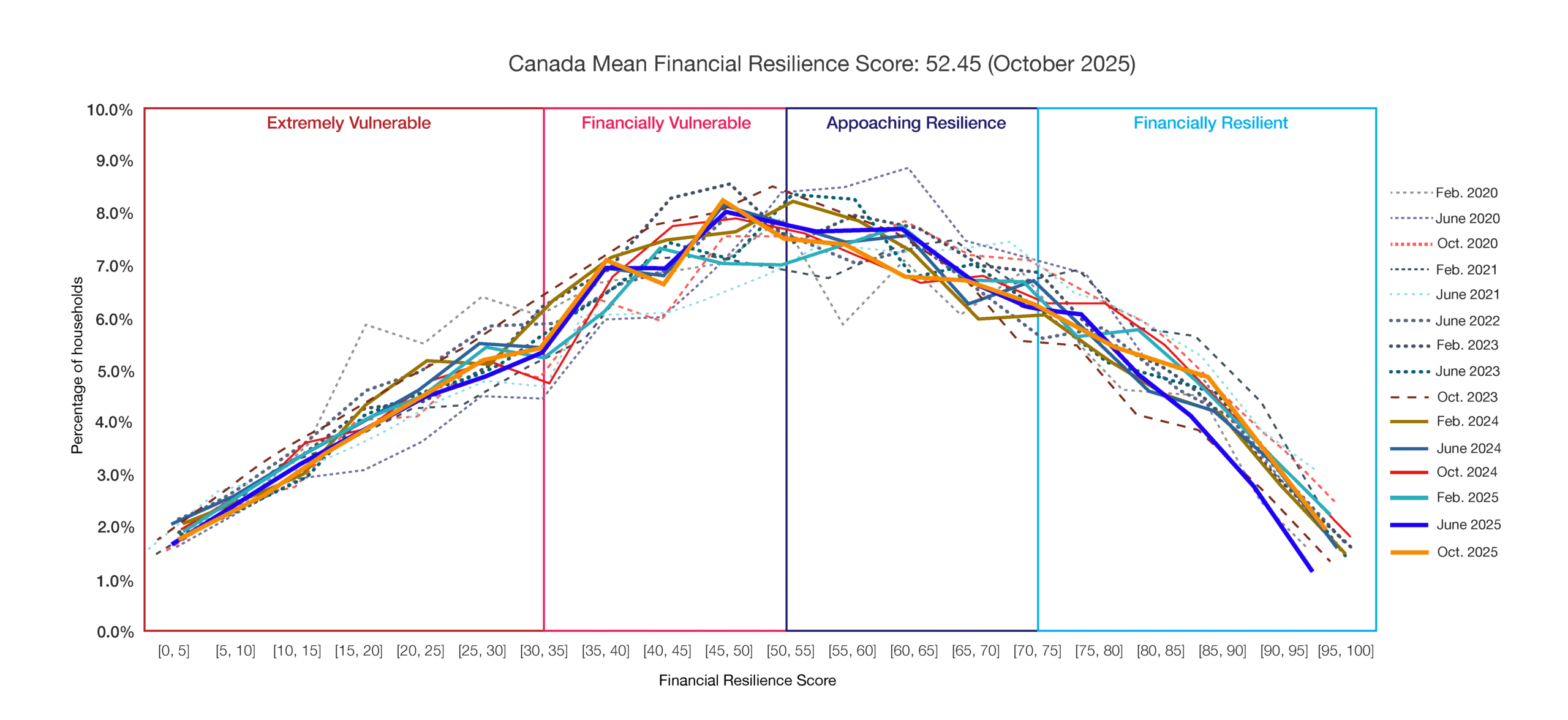

As of October 2025, Canada’s Mean Financial Resilience Score is 52.45, indicating households are only ‘Approaching Resilience’. Financial vulnerability spans all income levels, with 75% of households not ‘Financially Resilient’.

Financial Resilience Segments as of October 2025

Index Distribution from February 2020 to October 2025

As an independent authority, the Institute tracks the extent to which customers rate their Financial Institutions or Employers for helping to support their financial wellness over the past 12 months and business benefits in Canada. We also track which households are facing economic inclusion or other barriers; the financial vulnerability of key populations and more. As well, we are lead research, impact work and strategy around Employee Financial Resilience and Financial Wellness.

The power of key behavioural, policy and financial services interventions on improved financial resilience and financial well-being and overall well-being outcomes is made possible through Index analytics and reports, along with other customer, social and business benefits. The instrument has a longitudinal component and robust sampling and methodologies for comparability of data.

The Institute also develops proprietary models and in 2015, Eloise Duncan CEO and Founder created a robust proprietary Financial Well-Being Index Model based on transactional banking data for a leading Financial Institution client with this fully implemented and key indicators shared with UNEP-FI for its Financial Health and Inclusion Guidance for Banks. The Institute works with clients and partners to leverage reported Index data and transactional data in tandem with multiple applications and benefits.

By becoming a funder and partner of our non-profit Institute, your organization can help amplify impact, reports and thought-leadership: leveraging this instrument and others to help catalyze positive change.

Contact us to help us build our capacity and explore partnership opportunities, we’d love to hear from you.